Our recent updates can be found here: http://updates.xenapto.com

A quick story to illustrate how Xenapto models the sometimes complex relationships between organizations.

A private investor called SmartAngel takes a minority stake in a disruptive financial services startup called HotBank. SmartAngel’s stake doesn’t get them a board seat but their shares do have voting rights and they are entitled to attend and vote at HotBank’s Annual General Meeting.

What are their votes worth at this meeting? HotBank has several classes of share, some of them with voting rights and some with no voting rights. Even the shares with voting rights are in several classes; some with 1 vote per share and some management shares with 10 votes per share. SmartAngel’s shares carry one vote per share.

At the meeting, SmartAngel sends a representative to vote on several important resolutions. But SmartAngel is not one person; there are several of SmartAngel’s staff who might attend HotBank’s AGM. As a minority investor, SmartAngel’s staff might not all be known personally to HotBank’s company secretary. How does she know that the person attending the meeting is a legitimate representative of SmartAngel?

If HotBank’s AGM is a meatspace event then the SmartAngel representative might bring a signed proxy form with him, or HotBank might already have a letter from SmartAngel identifying its authorized representatives. The SmartAngel person needs only to identify himself as one of these people using a passport or other photo ID to satisfy HotBank that he is entitled to attend and vote on behalf of SmartAngel.

But let’s have a look at what happens if HotBank holds their AGM on Xenapto instead.

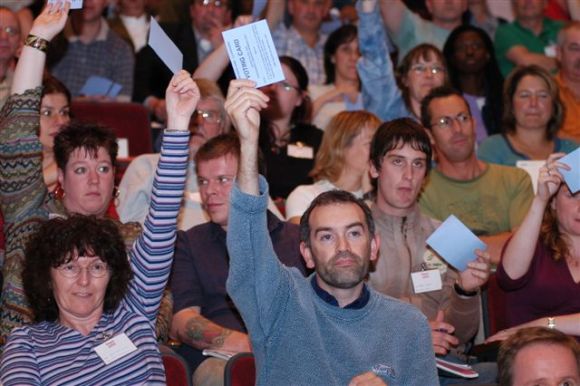

Firstly, the AGM becomes an asynchronous event. There might be a video or audio conference where HotBank’s management presents material to real-time participants but the business of the AGM can extend both before and after this presentation. Discussion of the AGM material can begin as soon as it is uploaded, with anonymity and confidentiality duly respected. Voting on resolutions can extend as long as required to ensure that all stakeholders have a chance to register their choice. Proxy voting can be managed with no delay waiting for forms to be posted.

But the way the relationship between HotBank and SmartAngel is modelled is the key to how Xenapto can deal with this complex event.

HotBank’s cap table is already stored in their Xenapto account along with option pools and convertible notes to give HotBank’s management an up-to-date view of their investors and a what-if tool to calculate liquidation values. But this cap table can also help manage the AGM easily. Alongside each share class is an indication of its voting rights, stored simply as a number of votes per share.

If the shareholders are also Xenapto users then the cap table also identifies their Xenapto account. So SmartAngel’s stake is an entry in HotBank’s cap table that links the two companies in Xenapto.

In SmartAngel’s account the other half of this relationship is exposed. SmartAngel users can see HotBank as a portfolio company alongside their other investments. Individual SmartAngel users can be flagged as people who are entitled to represent SmartAngel at HotBank’s general meetings.

When HotBank creates their AGM workspace on Xenapto, accredited SmartAngel users can sign in and begin interacting with the AGM materials and other AGM participants. When it comes to voting on the AGM resolutions, any of the accredited users can can cast SmartAngel’s votes on a given resolution.

Does that sound simple? I hope it does, because we’ve done a lot of heavy lifting under the covers to make this easy for Xenapto users. I don’t believe there is another tool that even has this on their roadmap.

Some interesting statements from Lucy Marcus in this conversation with Azeem Azhar of PeerIndex.

In the Boardroom: volatile startups need independent boards

Building the board gets lost in that things get busy, they’re busy doing other things, looking for money, looking for people, trying to actually build the company and the product.

Best practice for corporate governance in boards are the same everywhere, for any size company.

You want to start from scratch and build best practice into the DNA of the company.

Azeem talks about board transition: what happens when you get a new investor or a new founder, or when you add an independent director for the first time? You need to manage the board transition process.

Xenapto is in the business of ensuring that the boards of growth-stage companies find best practise is the best and easiest choice.

In December the New York Times ran a story that asked “is the high school reunion past its prime?” The thesis was that Facebook and similar services had made such infrequent meetings redundant.

“Even as a borderline user of social networking, I have a pretty good grasp of where people are, what they do, their family life, etc.,” he said. “So a lot of the mystery of the traditional reunion was missing.”

said one interviewee.

This chimed with what I’ve been thinking about board meetings since reading Steve Blank’s posts on the subject bank in June. He’s specifically talking about managing startups, but much of what he says applies equally to any company that has an active board. In particular, it’s worth reading the whole of Why Board Meetings Suck.

“Startup board meetings occur every 4-6 weeks. While that’s great when you showed up in your horse and buggy, the strategy-to-tactic-to implementation lag is painful at Internet speeds.”

And again,

“For the founders, “the get ready for the board meeting” drill is often a performance rather than a snapshot. Powerpoints, spreadsheets and rehearsals consume time for materials that are used once and discarded.”

And then, a very good question:

“In the age of the Internet why do we need to get together in one room on a fixed schedule? Why do we need to wait a month to six weeks to see progress?”

Why indeed?

The traditional board cycle as practised, well, everywhere is a 20th century construct constrained by what was possible when joint-stock companies were first invented. What has technology done for the board meeting in the last 100 years?

- Spreadsheets have replaced ledgers. This has revolutionized the production of reports, which previously would have been done by a laborious series of manual calculations.

- Duplication has gone from quill pen to carbon copies to photocopies to laser printed documents. Some boards now get their board packs on an iPad.

- Communications technology has allowed people to dial in or even appear on a video link.

This is all impressive but how has it changed the board process? The answer is not at all.

The clue to how to do this is in the New York Times story at the top. People put less value on infrequent meetings because they are in constant touch with each other. When stuff happens they know about it immediately – the reunion has less value as a catch-up exercise.

The board can do this already, and good boards do. As many people have said, there shouldn’t be any surprises at a board meeting. Controversial topics need to be aired in advance. The CEO shouldn’t expect to sell a brand new concept at the meeting itself.

“Nothing MAJOR is ever decided at the board meeting” – Mark Suster.

The thing is, we can make this easier. It’s already good practise; we can make it widespread. It shouldn’t depend on the people-management skills of the CEO, it should be built into the workflow.

It’s not even hard to do. We know how to get things done with Google Docs, Quora, Twitter, WordPress and Plaxo (or their many equivalents). Translate that knowledge to a secure, cloud-based service and there is the beginning of your asynchronous, social boardroom.

Straight away you can avoid the latency inherent in building a board pack. Board members can begin the discussion as soon as information is available. Conversation can proceed when people are free to pursue it, even in multiple time zones. The mere fact of storing one month’s report with its siblings from prior months ought to encourage some consistency in reporting. A permanent, searchable record of the conversation around a particular subject ought to discourage unproductive circular discussions and allow a corporate memory to evolve.

It’s also a good basis for automating the production of many of the reports. Once automated, consistency is built-in, as is freedom from human error. Trending and management by exception become possible. The focus of the board’s activities would be the company dashboard.

But people still have meetups, even people who live their lives online. Check out the activity on Meetup or Lanyrd; meetups are exploding, but they don’t take the format of a traditional board meeting. They’re an accelerated version of the preceding online conversation, where smileys are replaced by actual body language.

We needn’t get rid of the board meeting but we can make it a sleeker, more elegant thing. A board meetup.

Bibliography:

Steve Blank, Why Board Meetings Suck – Part 1 of 2

Steve Blank, Reinventing the Board Meeting – Part 2 of 2 – Virtual Valley Ventures

Fred Destin, Saving time in preparing for board meetings

Mark Suster, Running More Effective Board Meetings at Startups

Guy Kawasaki, The Art of the Board Meeting

First published here.

Welcome to WordPress.com! This is your very first post. Click the Edit link to modify or delete it, or start a new post. If you like, use this post to tell readers why you started this blog and what you plan to do with it.

Happy blogging!